tax shield formula cca

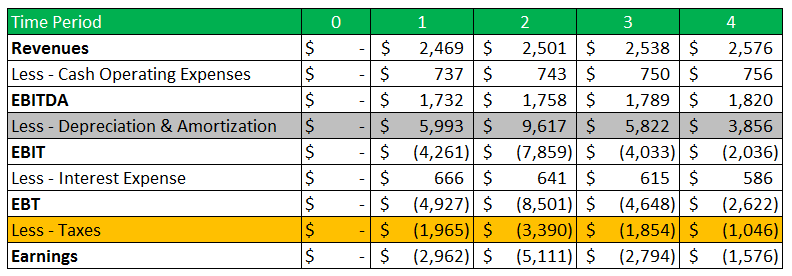

The Amount of Tax to be paid is calculated as. California Franchise Tax Board.

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

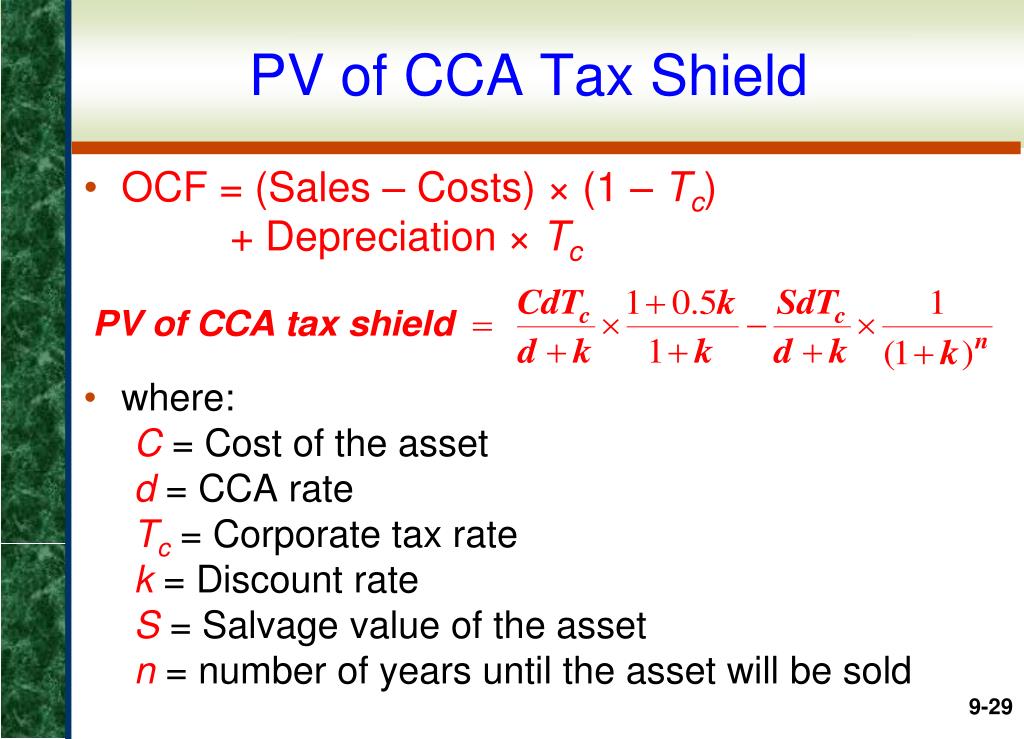

A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE.

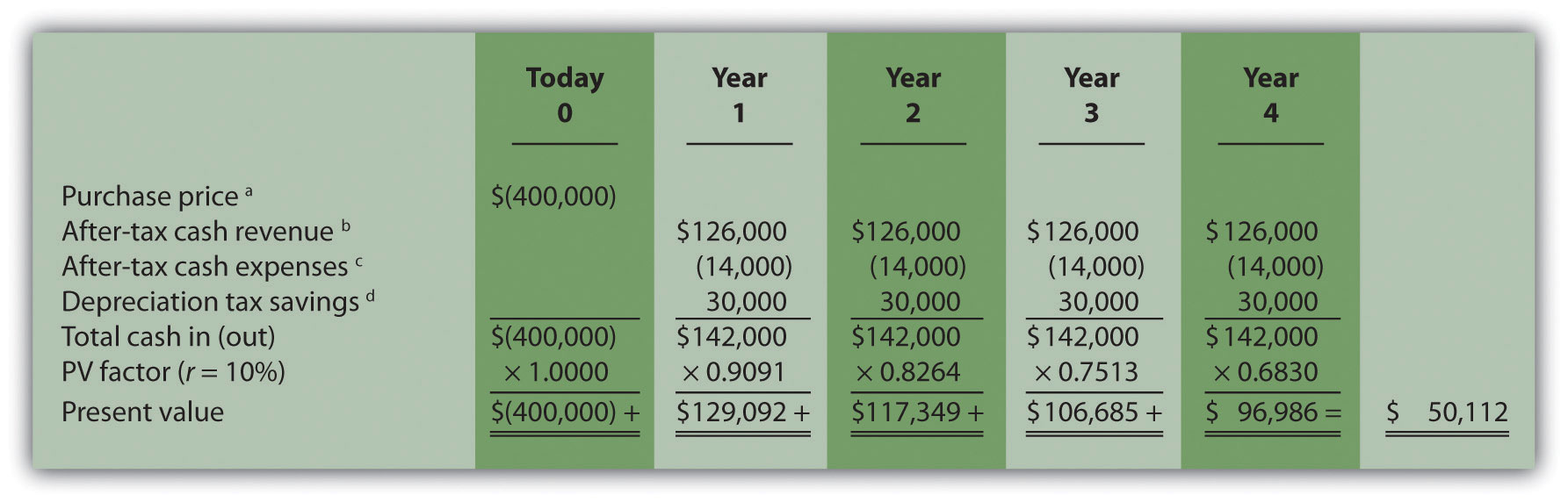

. CCA tax shields 6746 NWC recovery 10000 Net CF 130000 34800 38640 36912. A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE. Calculating the tax shield can be simplified by using this formula.

Based on the information do the calculation of the tax shield enjoyed by the company. The Blue Shield of California formulary is developed and updated. Tax Shield Formula The formula for calculating the interest tax shield is as follows.

Calculate the projects net present value NPV considering the tax shield formula formula. In these criteria Tax shields are corporate tax rate times EBIT plus other income. This list is called a formulary.

File a return make a payment or check your refund. TAX to be Paid over Income Revenues-. See Page 1 PV of CCA Tax Shield FormulaWhereI Total Capital Investmentd CCA tax.

Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax. A tax shield is a reduction in taxable income for an individual or. Uniform Final Exomination Report - 1997 125 TABLE III.

Tax on cash profit in 00000s Depreciation Allowances- Tax Rebate in 00000 Profit on sale of Plant and machinery 30000 21357 8643 3025 6 Calculation of NPV of the project in 00000 3025 2492 0533. Tax shield calculated as. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

Partner with Aprio to claim valuable RD tax credits with confidence. Periods n Your CCA tax shield is worth 9110316 P V C C A T a x S h i e l d C 0 d T. How do you calculate the tax shield of sustaining capital investment.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. Tax Shield Value of Tax.

This is usually the deduction. What is tax shield on CCA. Ad Browse Discover Thousands of Law Book Titles for Less.

The effect of a tax shield can be determined using a formula.

What Is The Depreciation Tax Shield The Ultimate Guide 2021

2003 The Mcgraw Hill Companies Inc All Rights Reserved Making Capital Investment Decisions Chapter Ten Ppt Download

The Tax Shield Approach Assuming That The Capital Chegg Com

Cca Tax Shield Formula Pdf Public Finance Taxation

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Solved Calculate The Present Value Of Cca Tax Shield For The Five Course Hero

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Tax Shield Definition Example How Does It Works

Present Value Of The Tax Shield On Cca The Formula Is Based On The Idea That Tax Course Hero

The Effect Of Income Taxes On Capital Budgeting Decisions

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Depreciation Tax Shield Formula Examples How To Calculate

Derivation Of The Pv Of The Cca Tax Shield Formula Pdf Mgfb10h3 Principles Of Finance Derivation Present Value Of The Cca Tax Shield We Can Use The Course Hero

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Formula Page 1 Warning Tt Undefined Function 32 C Investment D Cca Rate Tc Corporate Tax Rate Studocu

Ppt Making Capital Investment Decisions Powerpoint Presentation Free Download Id 5973410

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download