how does inheritance tax work in florida

Some people are not aware that. Bar-Certified Lawyers are Ready Now.

Does Florida Have An Inheritance Tax Alper Law

2 Inheriting at death is.

. Your taxable estate represents your estates total value. However you should ask your. 7031 Koll Center Pkwy Pleasanton CA 94566.

The inheritance is a tax imposed by some states on an heirs right to receive his or her inheritance. As a result of recent tax law changes only those who die in 2019 with. Like most other states Florida does not levy a local gift tax.

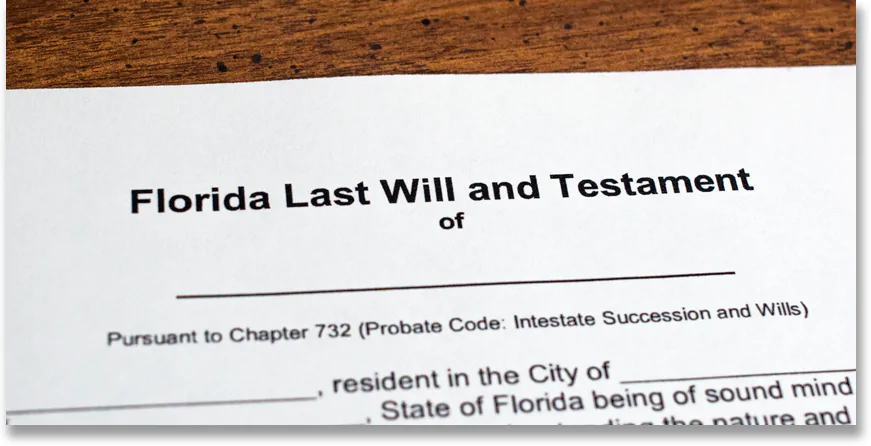

Legally in an estate estate where the property is owned by the decedent alone the title to the homestead real estate passes to the heirs at law surviving spouse children etc. An inheritance tax is actually the tax on a beneficiarys right to receive an inheritance. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax.

West Palm Beach probate lawyers know that Florida does not have independent estate or inheritance taxes. Does Florida have an estate tax. While many states have inheritance taxes Florida does not.

What is the Inheritance Tax. If you die without a will in Florida your assets will go. Its levied by the state and Florida does not have one.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Given the fact that very few of us will inherit a. You have to pay taxes on the 100000 gain.

Each state is different and taxes can change at the drop of a hat so its a. You sell the house after she dies. So the taxable income amount of the inheritance would be 40000.

Up to 25 cash back Do Not Sell My Personal Information. At the same time the Federal Gift Tax Exclusion has an annual. Gift tax helps to plan your estate in Florida.

When applicable state taxes are included the combined rate is an average of about 25. Most of the states that have. Florida Inheritance Tax and Gift Tax.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no. Ad Find Reliable Answers to Legal Questions Online. The federal government levies a fixed 21 corporate tax rate.

The Florida estate tax is different from other states. If the tax rate for a 40000. There is no inheritance tax in Florida but other states inheritance taxes may apply to you.

You are required to file US. There is no federal inheritance tax but there is a federal estate tax. Inheritances that fall below these exemption amounts arent subject to the tax.

Inheritance Tax in Florida. Federal Estate Tax. Florida residents are fortunate in.

If it is worth more than that however it must pay this tax which ranges from a marginal rate of 18 percent to the top rate of 40 percent. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

Inheritance Tax in Florida. In 2012 Mom deeds the house worth 110000 BEFORE she dies. Florida also does not have a separate state estate tax.

The federal estate tax however. In Pennsylvania for instance the inheritance. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. You would pay an inheritance tax of 11 on 25000 50000 - 25000 when it passes to you. The state in which your brother lived allows a 10000 exemption for siblings.

In addition it can be difficult to calculate the amount of taxes owed after a person dies. The tax is levied based on the value of the. There is a national tax exemption for estate tax for up to 114 million from one decedent and 228 million if the decedent was married.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

State Estate And Inheritance Taxes Itep

Does Florida Have An Inheritance Tax Alper Law

Is There An Inheritance Tax In Texas

How To Calculate Inheritance Tax 12 Steps With Pictures

Florida Estate Tax Rules On Estate Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die